Accept payments. Faster. Easier. Smarter.

Getting paid just got better because with Clover, you can accept credit cards, debit cards, gift cards, and contactless payments, at any time, from anywhere – a complete point-of-sale system.

More ways for customers to pay.

Build your own POS system

Choose your plan, devices, and accessories with just a few steps.

Faster, stress‑free set‑up – with a little help from our team

Convenient, concierge-style set-up support from experts who understand your unique business.

Get paid wherever you are

Faster, simpler, safer

Run card transactions in seconds

Set up tax rates once, and apply them automatically

See most deposits in your bank account the next day

Get full encryption on a PCI‑certified system

Get fraud protection up to $100,000

Take payments with or without WiFi

Process offline sales when you reconnect

Rely on 24/7 expert phone support

Take payments anywhere, anytime with Virtual Terminal

Accept payments anytime, anywhere with your computer, tablet, or smartphone using Virtual Terminal on your Clover Web Dashboard. No POS device needed!

Let them pay and go

Turn tables faster and give your guests the freedom to pay tableside. Introducing Scan to Pay, available only with Clover Dining.

Make accounting automatic

Download your sales data or integrate with popular accounting apps such as QuickBooks and Xero.

Payment processing and then some

- Process faster transactionsYou’ve got a need for speed – quickly and more securely make sales with Clover’s payment processing solutions.

- Help prevent fraudYour customers can shop with confidence. Clover is a PCI-certified system, so you can protect your business and customer information.

- Manage all moving partsFrom scheduling employees to engaging with customers – operations run smoothly from one Clover Dashboard login.

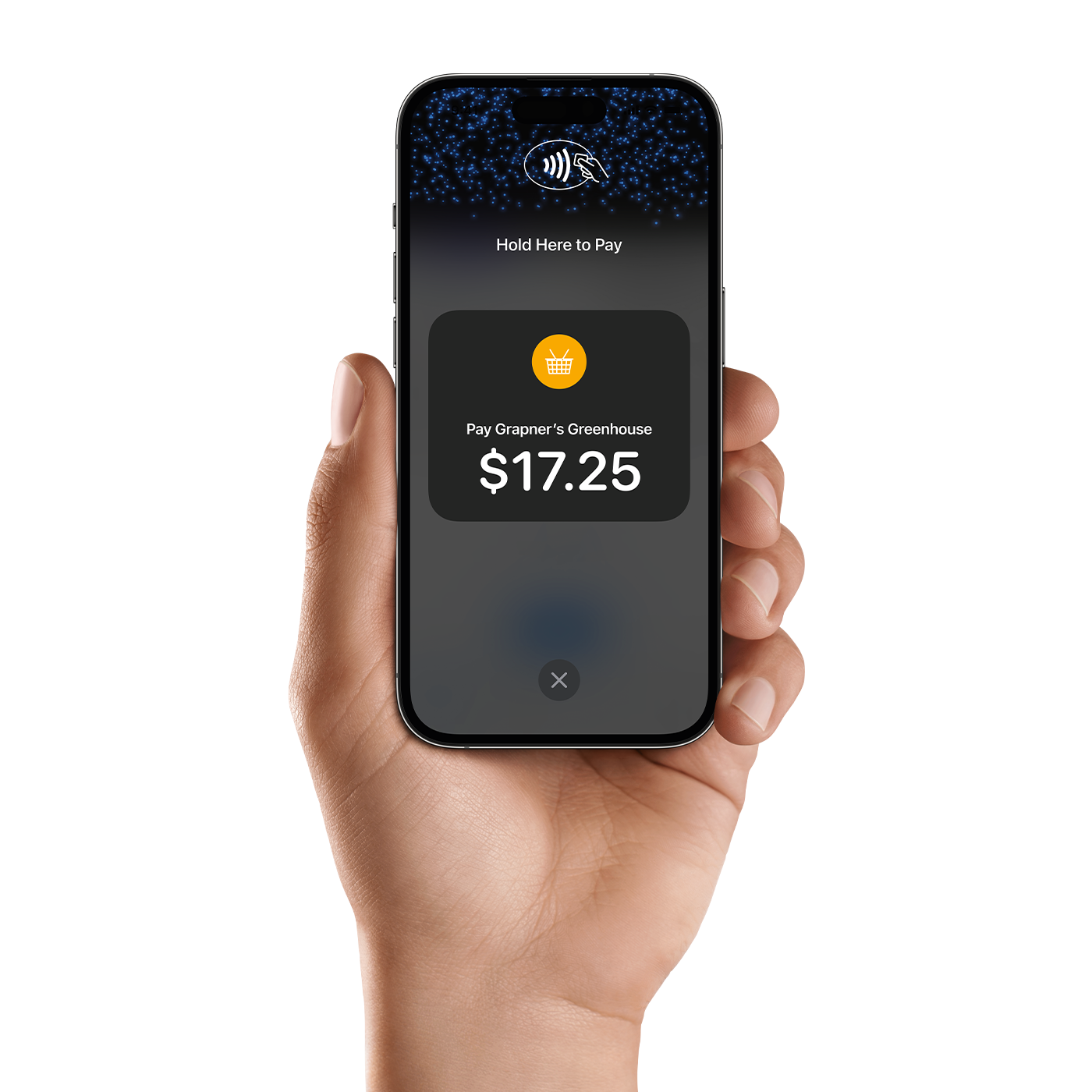

Take contactless payments right on your iPhone

Accept all types of contactless payments - from contactless credit and debit cards, Apple Pay and other digital wallets. No extra hardware required.

Peace of mind with your system

Free overnight shipping*

Once you’re approved, your system will arrive in one business day. *Online orders only.

Quick and easy set up

Set up your business and start taking payments all in the same day with the Clover Dashboard.

Consistent rates

All cards, including AMEX and rewards cards, feature the same low rates.

Help when you need it

Ready to assist you with everything from setting up to troubleshooting.