Merchant services and account types

Clover's merchant services and credit card processing solutions include innovative technology and expert support to help you run your business and meet your payment processing needs.

Trouble‑free merchant card processing services that save money and help protect customer data

Work with our merchant account solutions team to define your payment processing needs.

Select from options including contactless payments, online payments, mobile processing, and chip card acceptance.

Follow our simple path to secure customer data and PCI compliance.

What is a merchant account (and why do you need one)?

A merchant account is a special type of bank account that allows retail stores, restaurants, and other business types to accept payments made via credit card, debit card, or mobile wallet. It acts as an intermediary between your business and the card-issuing banks.

Merchant accounts (or third-party equivalents) are required for card acceptance. Without this type of account, your business will be limited to cash or checks.

Small business merchant accounts

Start accepting credit card payments with ease and grow your business. Because we work with many industries and business types, our merchant services can quickly scale with your growing operations.

Every credit card merchant has different needs

- Choose an all-in-one payment solutions providerWe offer expert assistance in selecting the right merchant credit card processing solution for your unique needs.

- Comply with PCI standardsWe help you comply with PCI standards to help protect your data and your customers’ data.

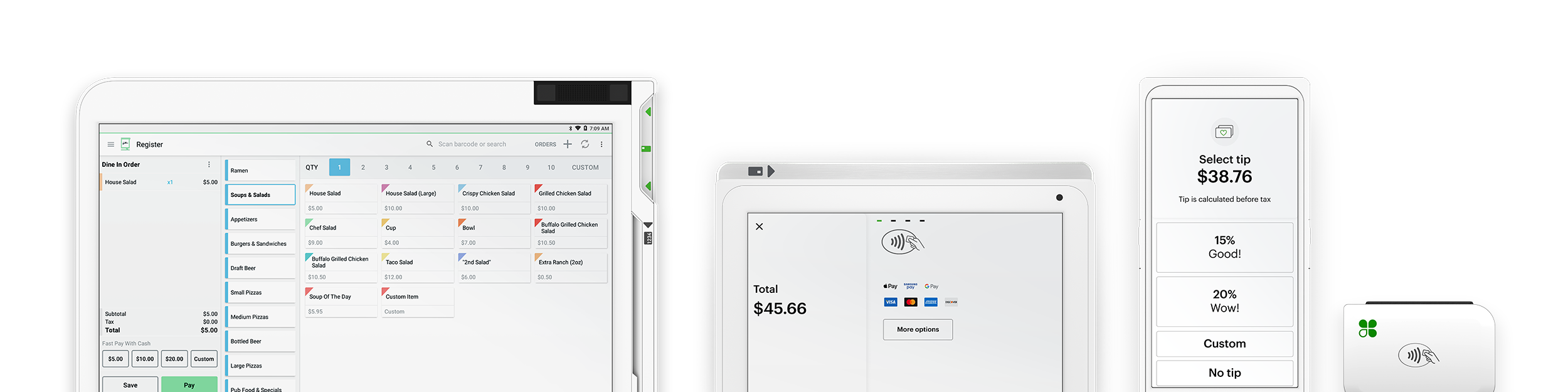

- Accept multiple payment optionsWith our merchant credit card processing solutions, you can accept payments via a POS device, web browser with a virtual terminal, mobile device, eCommerce store or website, and more.

Get your new Clover system

It’s never been easier. Set up your Clover POS system with the right mix of devices and apps for your business. Add more devices or apps any time. Order directly online or talk to us about your ideal device and plan options.